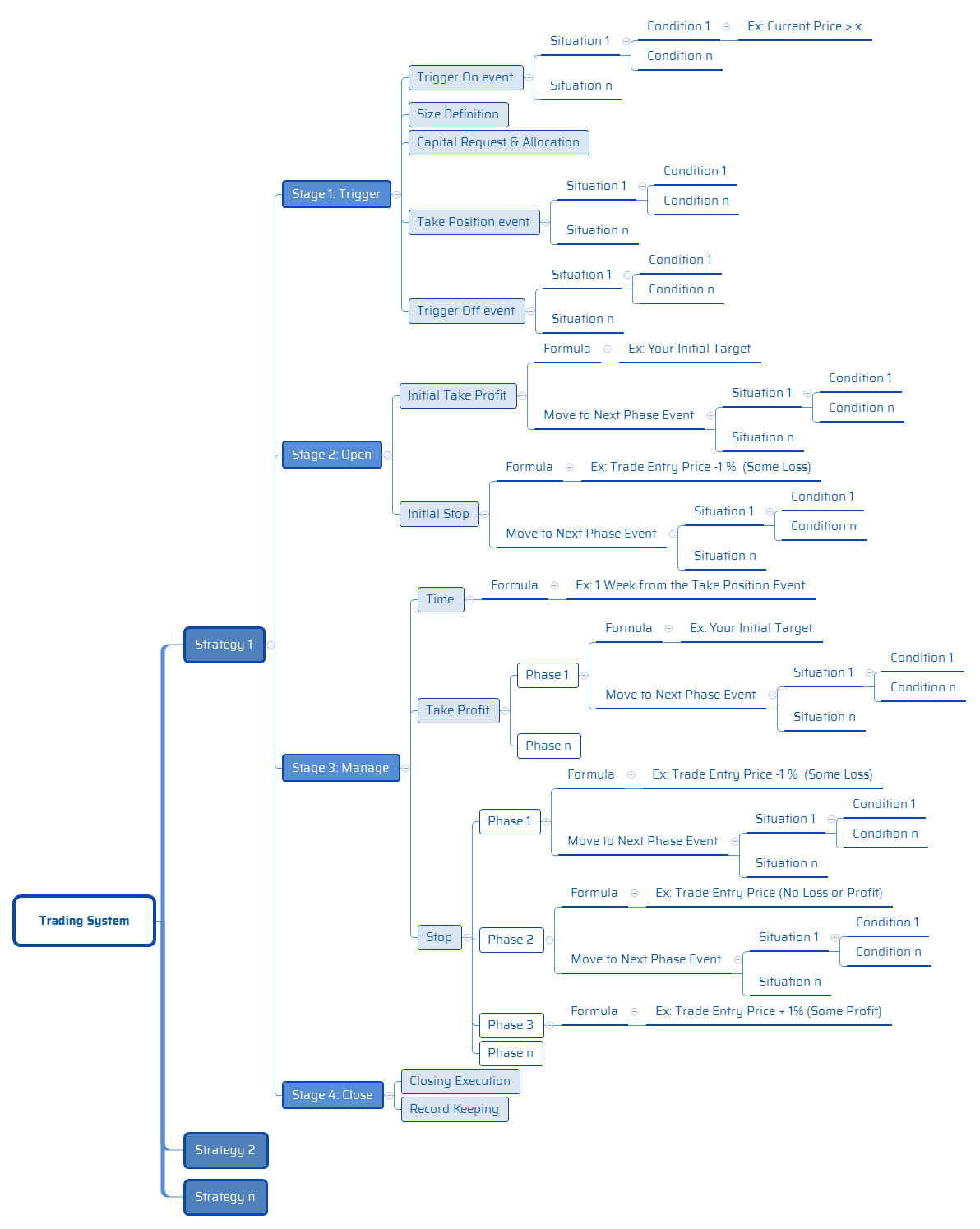

- Base algorithm - 5

- Stage 1: Trigger- 6

- Stage 2: Open- 7

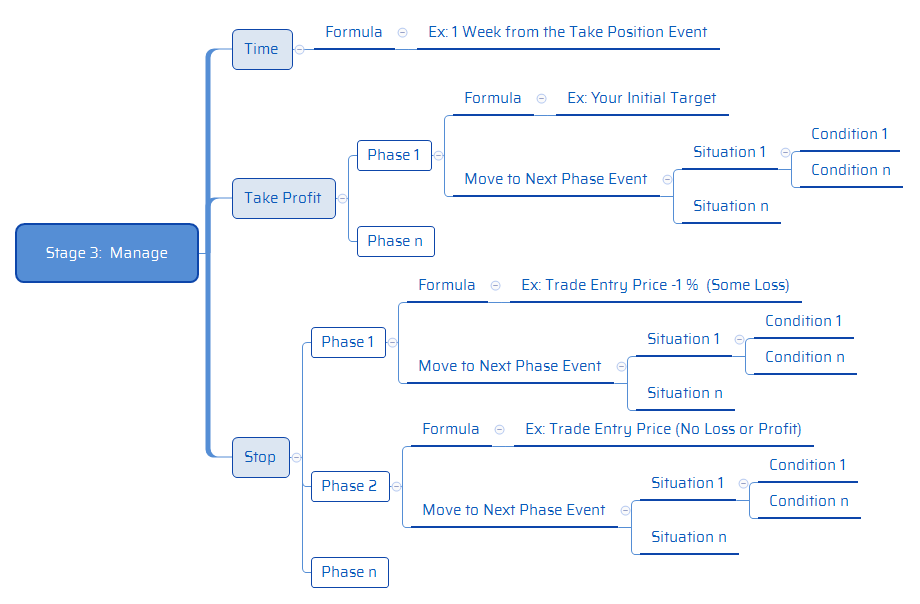

- Stage 3: Manage- 8

- Stage 4: Close- 11

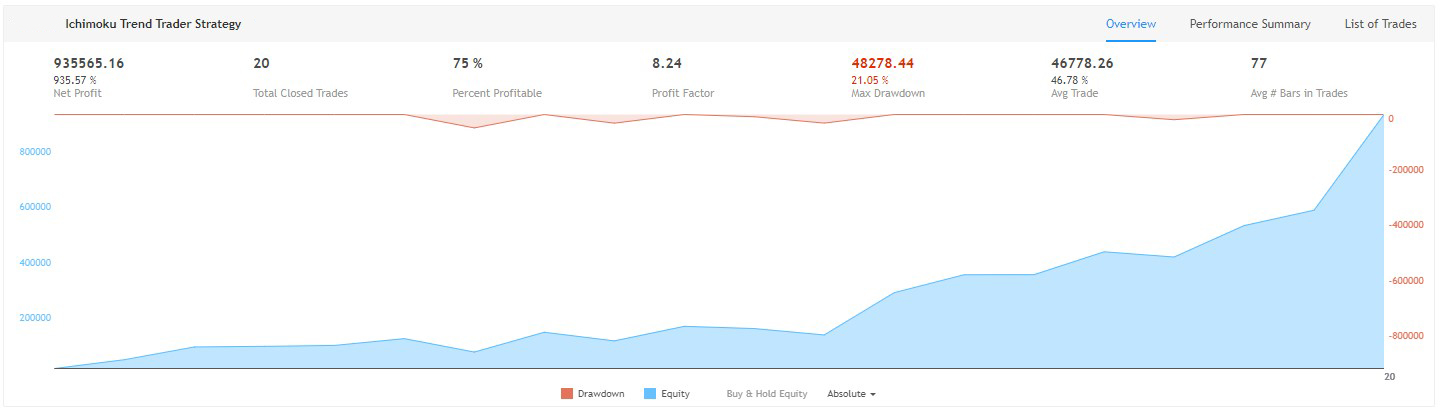

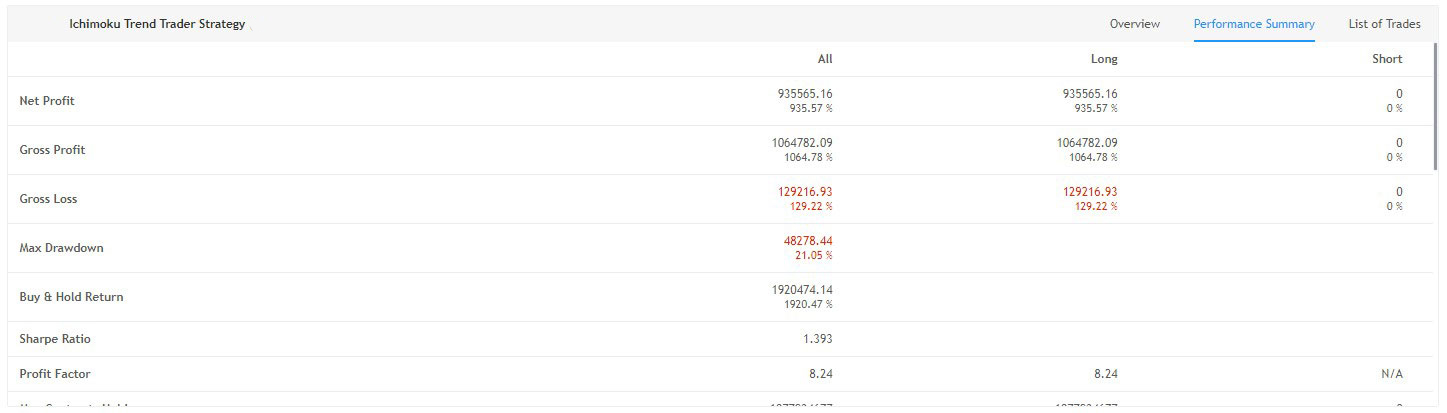

- Ichimoku Trend Trader Strategy- 13

- Percentage Tracker Strategy- 15

- RSI + Stochastic Strategy- 16

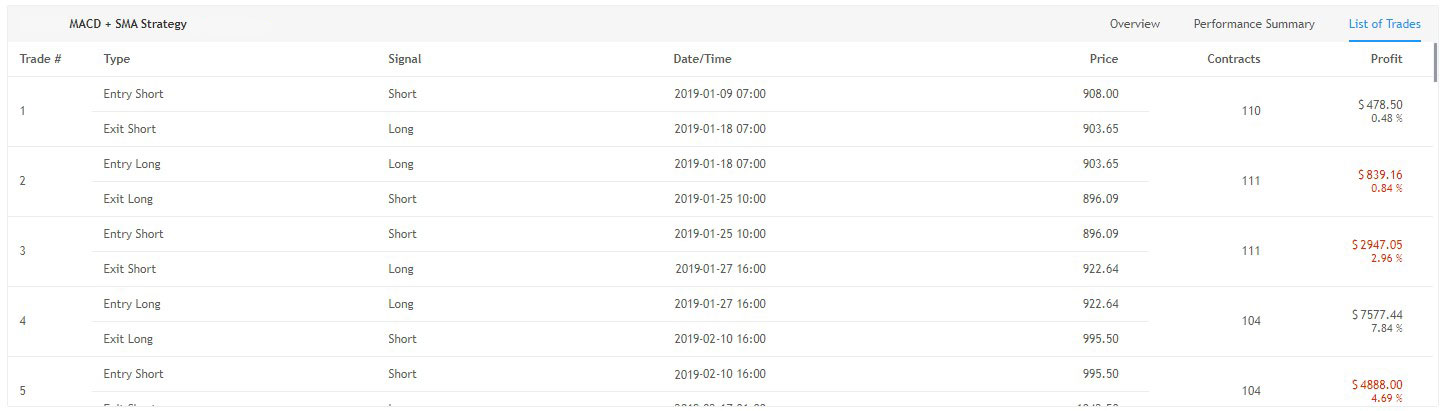

- MACD + SMA Strategy- 17

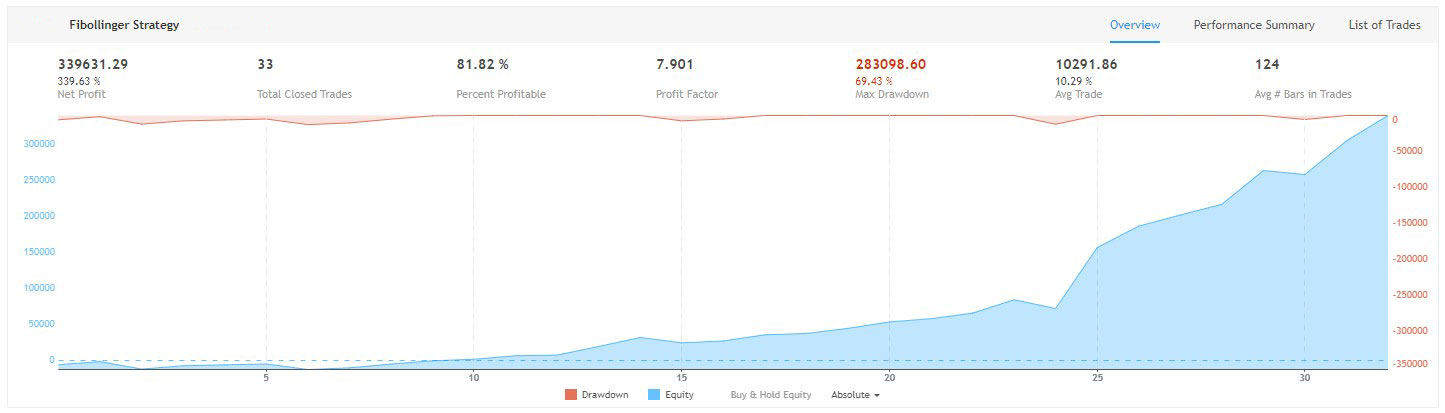

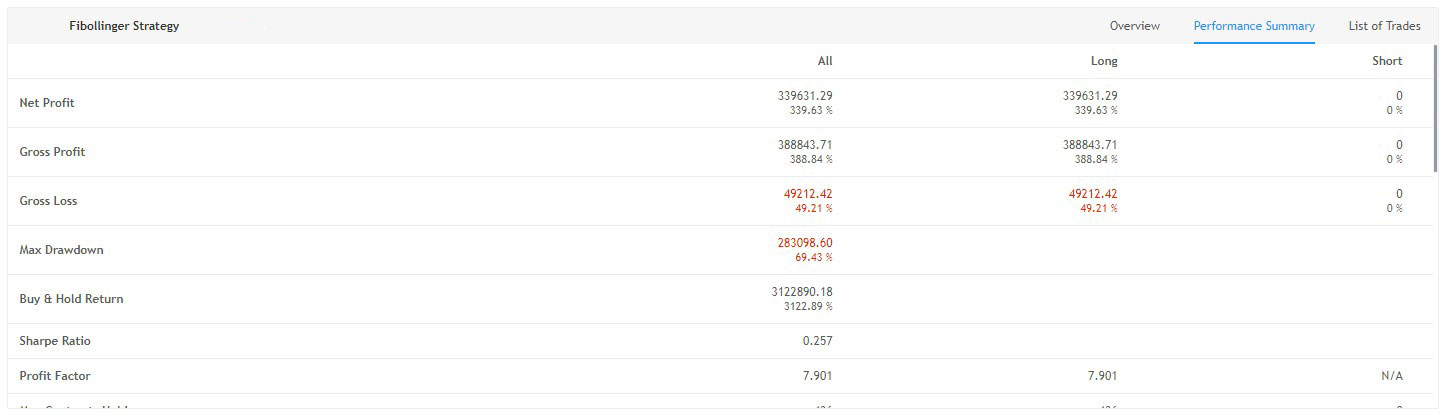

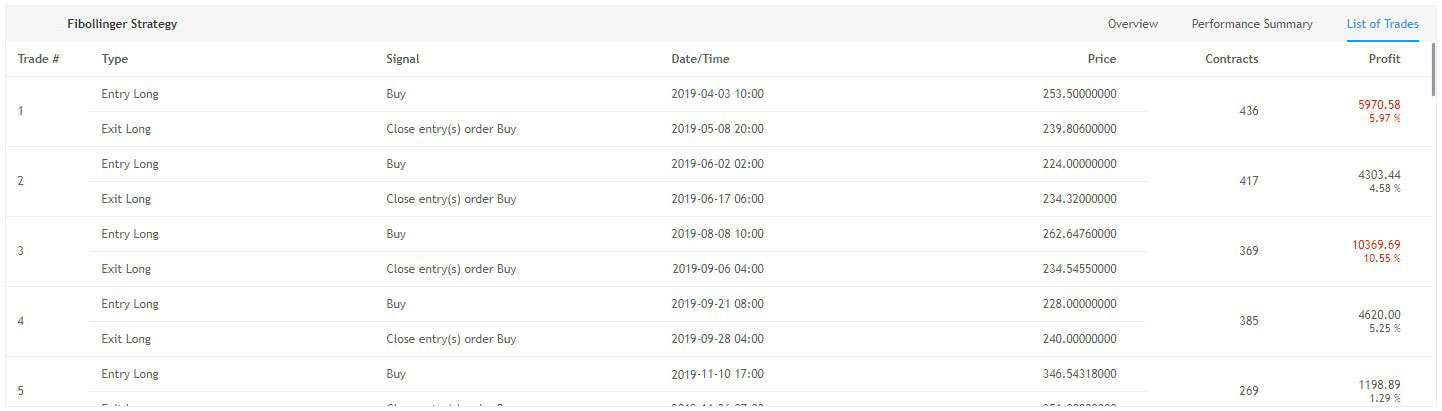

- Fibollinger Strategy- 19

- MACD + Stochastic Strategy- 21

- RSI + BB Strategy- 22

- Automatic Fibonacci Strategy- 23

- MFI + HA Strategy- 24

- Conclusion- 25

What is Cryptex?

Cryptex is a special system, which is also known as a trading robot, that analyses what�s going on in the financial market and finds the best offers for you. Cryptex can trade on several assets at the same time that helps to increase security, reduce risks and ensure almost guaranteed profit. A trading robot doesn't care whether the price rises, falls or stays at the same level for a long time. It always finds a way to make money because the price of different assets changes every day.

Cryptex helps not only with analysis but also allows a trader to automate opening and closing orders. To do that, first of all, Cryptex needs a trading signal which is based on technical analysis. Cryptex analyzes technical indicators by itself to create a trading signal that will be used to open and close orders. Yes, you can do TA on your own but a trading robot does that much faster than human beings.

Note: Technical analysis is the study of charts. TAs watch the price looking for patterns, and use indicators to determine market conditions. An indicator is a mathematical function on the price and/or volume of an asset. And a pattern is an arrangement of prices over a timeframe.

This means a technical trading strategy boils down to numerical analysis, and math problems. Computers are much quicker, and more accurate than humans at solving math problems, so why not tell your computer what the rules of the game are and let it trade for you? That�s what Cryptex can give you.

Cryptex helps you to identify the situations where you should open a position, and where you should close a position. It�ll be faster and more accurate then do it by yourself. It means Cryptex is configured to perform repetitive actions. It is written in order to save a person from mechanical and monotonous work.

The benefit becomes clearer if we look at a more advanced example. Suppose you wanted to combine 5 indicators and scan a basket of 7 different assets for a trade entry. That�s a lot of information the human mind to handle. You�ll be switching back and forth between screens looking for your indicators to light up green and telling you to get into the market.

3The possibility of making a mistake is amplified when your attention is split over multiple markets. This is when Cryptex shines. The capacity for the Cryptex�s algorithm to handle multiple assets and indicators is much greater than that of any of us.

- Ability to trade non-stop

With a trading robot, you can trade profitably 24 hours a day and increase your profits.

- Removes emotions from trading

One of the main reasons why traders fail is emotional trading. However, Cryptex eliminates emotions from the trading equation and gives you a reliable way of earning money.

A robot cannot fear to make a trade neither can it start making greed-driven decisions.

- Reduces trading errors

Automated trading systems can perform complicated calculations without making errors.

Since humans can be at fault, traders normally find themselves making silly mistakes, which could have been avoided. Since robots make decisions based on preset rules, they greatly minimize trading errors.

It�s important to say that losing trades are also possible but don�t be afraid about that. The perfect system doesn�t exist but Cryptex almost approached it. 80% of Cryptex trades are successful. It�s a nice result that allows you to have an almost guaranteed profit.

4How Cryptex works?

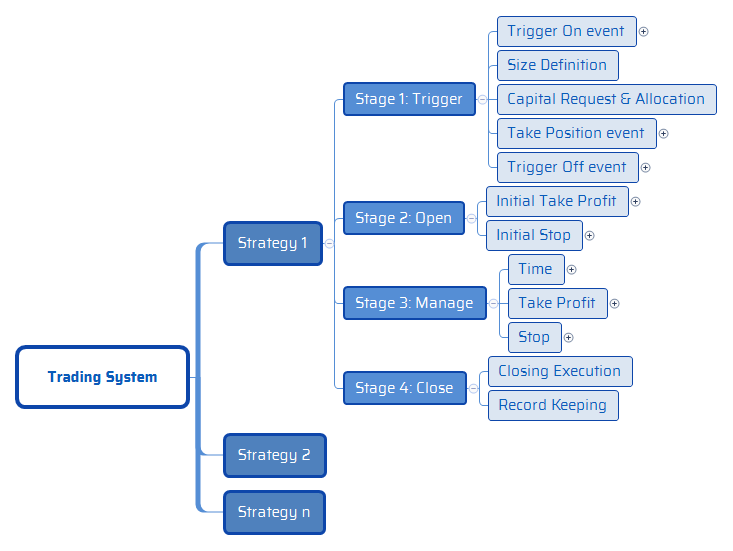

At this part, we are talking about Cryptex�s logic and what actions Cryptex provides to make money in the financial market. You can find here Cryptex�s base algorithm. If you want to know what strategies Cryptex uses to make decisions, do technical analysis, and open/close orders, you can find it in the third part of this manual.

Base algorithm

In terms of structure, you can think of a trading system as a hierarchical arrangement organizing the actionable aspects of your investment plan.

Here is a simplified version of the Cryptex trading algorithm.

The first order of things is determining how much money you will be working with. This is your initial capital. It is up to you to determine what capital you will use for trading. You will need to manage this capital (deposit funds,

5withdraw funds, reinvest profit, etc). Cryptex will help to preserve it and aim to increase it.

After that, it�s important to find your market. There are many reasons why you may prefer one market over others. Liquidity, volatility, the likability of the underlying project� you name it. You can choose which market/asset you want to trade and Cryptex will find the best offers only in that particular market/ asset. Or you can allow Cryptex to decide and the trading algorithm will start analyzing and searching for the best offers to make money in the financial market.

Stage 1: Trigger

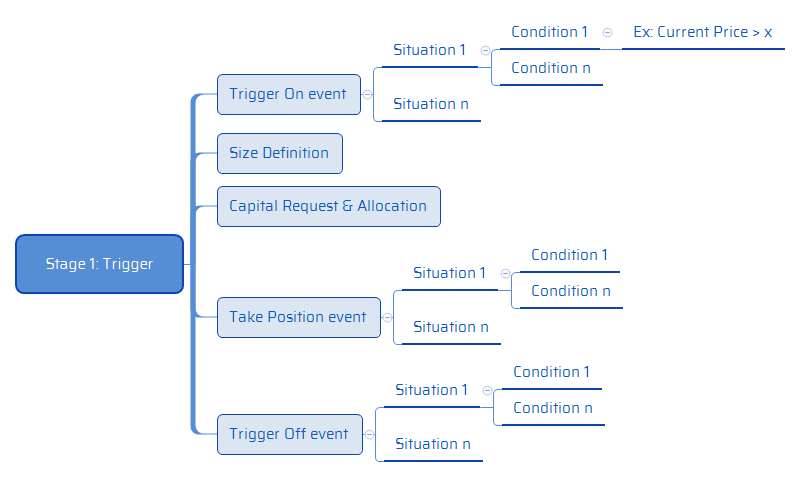

When do you start trading? How do you know which strategy to use? Those two questions lead you straight into Stage 1.

First of all, the trading robot is trying to determine what is going on with the market and if the situation is right to use a certain strategy. In other words, Cryptex defines situations in which it�s better to use a certain strategy and each situation is described as a set of conditions that need to be met to consider starting to use the chosen strategy.

When the conditions for any of the situations that would trigger a strategy are met, it�s a trigger on an event, meaning the event activates the strategy. So, the

6chosen strategy is guided by predefined conditions that � when met � define situations that determine that a certain event will take place.

Before taking a position, it will be necessary to define the amount of base asset that you are going to risk in the trade which points back to one important concept we touched on before: capital.

It was established that you have a certain amount of capital to trade with and that you will need to manage. It was also established that you are most likely going to work with several strategies.

This is when you start managing your capital. Or you can give robot access to manage it partly/in full. For example, you can set the amount of capital to trade with on a particular deal or give robot rights to decide what amount is appropriate to trade with.

When setting up the strategy, the robot will describe situations, each defined by a set of rules or conditions that � when met � indicate that the moment is ripe for taking a position. It takes a position event.

Taking a position refers to the act of entering a trade, that is, placing the orders at the platform. These actions are taken in the next stage, during execution.

So, Stage 1 is about monitoring the market and identifying when the conditions that define certain situations are met, triggering one of the strategies.

You may see this as an early signal that tells you an opportunity may emerge soon. The conditions that define the situation for actually taking a position may be seen as the final confirmation: the signal that determines that the time for entering a trade is as good as it gets. These conditions are based on technical analysis of indicators and strategies.

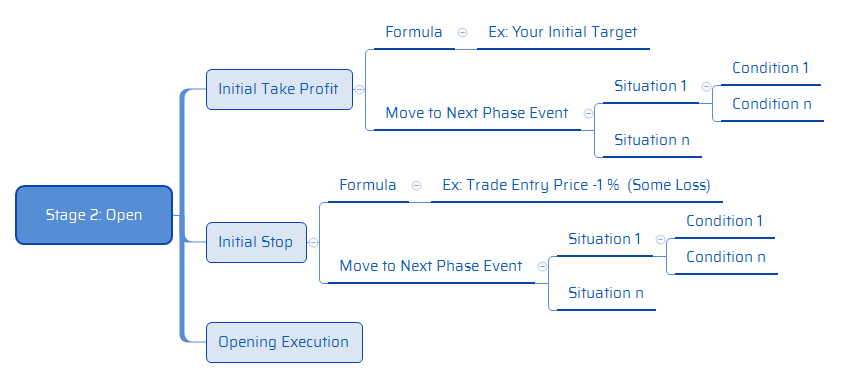

Stage 2: Open

So, the robot has decided when is a good time to take a position. Good.

However, to complete the trade � that is, to buy back the base asset (mostly USD) � you also need to define the rules to exit the position, or what is called take profit and stop loss. You can set take profit or stop loss by yourself, tell your manager to do that or give robot rights to set it.

7

As per the definition of trade, the main rule is minimizing the amount of the potential loss and the goal is completing the trade at a profit, that is, ending up with a higher amount of your base asset.

In that sense, the next step is defining two separate rule-sets for exiting the position: take profit and stop loss. These rule-sets are most likely expressed as mathematical formulas as a percentage of the price at the time of the take position event.

You/your manager can set these positions by yourself but robot set it, taking into account market volatility, average asset volatility, your risk profile, quality of the signal and long-term targets.

If Stage 1 was mostly about monitoring the market, Stage 2 is about execution: the robot has identified that the moment is right to take a position, now it�s time to go and do it.

Stage 3: Manage

The term trade management implies that the rules set forth for the take profit and stop don�t need to be static. It means that the formulas to determine the take profit and stop may change as the trade develops.

Then, how the robot manages the trade? What could happen that would make robot want to change your take profit and stop loss formulas? How does Cryptex determine when to change them?

8The development of the trade is analyzed through the same lens Cryptex has been using throughout the previous steps, meaning that the trading robot keeps looking at the state of the market in relation to all the indicators which is used to analyze, in an attempt to predict what may happen next.

But, most importantly, Cryptex analyzes the market with a focus on your current targets, embodied by the originally defined take profit and stop loss.

The typical situation in which robot may want to change your original take profit and stop loss formulas is when the trade seems to be going well in your favor. That is, the market is moving in the expected direction and you seem to be making a profit.

Why would robot want to change anything at all if things are going according to your/its expectations?

First of all, as long as the position is open, you haven�t accrued the profits! Even if you seem to be winning, the market may reverse before hitting the take profit and may go all the way back to your stop loss.

So, Cryptex moves your stop loss as the price moves in the expected direction in such a way that even if the market reverses before hitting the take profit, you would end up with a smaller loss, with zero loss or even with a profit, depending on how much robot manages to move the stop.

A second potential scenario is that the market moves in the desired direction and does not reverse. In such a case, if you did nothing to manage the trade, you would hit the original take profit.

Good, right? Now, what if the market keeps going way beyond the initial take profit?

Indeed, you would have missed a good opportunity to surf a big market move and make a much larger profit than originally expected.

The conclusion is that the best option is to manage both stop loss and take profit, moving them in the direction of the trade as the market moves, allowing some leeway for a larger profit than expected and at the same time cutting the potential for a loss.

9Cryptex can manage that for you automatically. Cryptex has no greed as human investors have, that is why its decisions of the best level of take profit and stop loss are fully based on constant technical analysis of market indicators, not emotions. Again, you can manage the stop loss and take profit by yourself or with your manager, but as usual, Cryptex can do this for you if you want.

The management of the trade is handled in phases. Actually, the management of take profit and stop � while correlated � is done independently of each other, therefore, each concept has its own set of phases.

Changes to take profit and stop loss formulas respond to the same kind of logic robot used to set the original values. When a situation defined by a set of conditions is met, the event indicates that take profit or stop loss formulas shall be changed. At the moment those predefined conditions are met, robot enters the next phase. There may be as many phases as robot deem appropriate for your chosen strategy.

The idea of having different phases comes from the notion that big market moves tend to provide clues as to what may come up next.

10Stage 4: Close

The Closing Stage has very similar implications to what was explained in the Open Stage in regards to execution.

While it is true that the trade management process takes care of making the decisions as of when to close the position by managing the take profit and stop, the actual execution of the exit may require further considerations when dealing with substantial amounts of capital.

That is why it�s better to understand execution as a separate stage, while it may not be required in practical terms if you are trading a small capital. If that is the case, then trade management includes the actual execution and robot don�t consider any other variables.

So, here is the basic Cryptex�s framework analyzing the four stages of a trading strategy.

11

From the triggering the situation to closing the deal, Cryptex is analyzing market indicators to find the best possible options to open and execute an order. Constant technical analysis helps to reduce risks, remove emotions from the equation, find the most appropriate stop loss and take profit, and maximize the

12profit with improved management system (automated take profit and stop loss).

In this part, we described all the stages of a single deal. But, as we mentioned above, Cryptex can trade on several assets at the same time that also helps to increase security and reduce risks.

How Cryptex makes decisions about what to trade?

In this part, we are talking about market indicators and strategies (combinations of market indicators) which Cryptex uses and constantly analyzes to make decisions what�s better to trade at a certain period of time. You can give Cryptex access to analyze one chosen asset, set of assets, chosen market or all the specter of assets which you can find on the trading platform. It contains its trade with specified parameters on the chart so you don�t have to worry about unexpected surprises. It keeps all the risks to a minimum with the powerful risk management feature set, including normal and trailing stop loss options, which were described in �Stage 3: Manage�.

At the moment, the Cryptex algorithm relies on 9 strategies that are used in the trading process. The robot itself can choose a strategy to open an order and maximize profits. The basis for selecting a strategy is the asset features, its volatility, and the general market situation.

Below are all these strategies and indicators which Cryptex robot uses in its trading. You can also find there small descriptions of the indicators, overall results of trading strategy after its separate tests (only one strategy used), and average strategy result per trade.

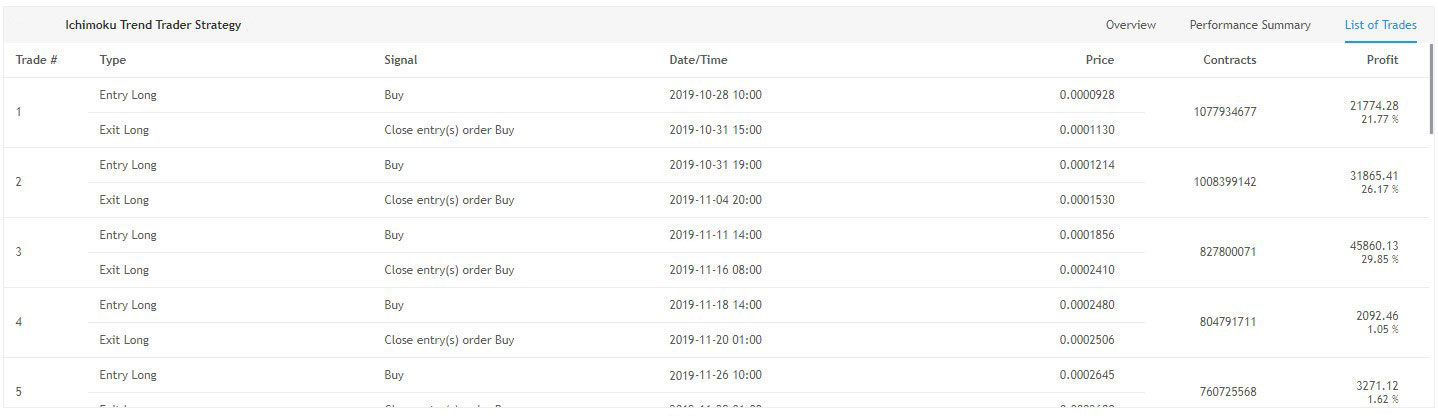

1. Ichimoku Trend Trader Strategy

It is specifically designed to capture breakout trends or large price moves. Typically, this trading strategy is geared towards larger time frames but can be adjusted to suit specific trade pairs. The Ichimoku system is a patient trading strategy that minimizes the number of trades produced but maximizes profits for the trade signals generated.

13The Ichimoku is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on the chart. It also uses these figures to compute a "cloud" which attempts to forecast where the price may find support or resistance in the future.

Here are the overall results of the Ichimoku trading strategy and the average strategy result per trade.

As you can see, the net profit of this strategy after separate tests was 935%, average profit per trade � 46,78%, and percent of profitable trades � 75%. It�s

14a nice strategy to use even separately, but along with other strategies, it can show much better results.

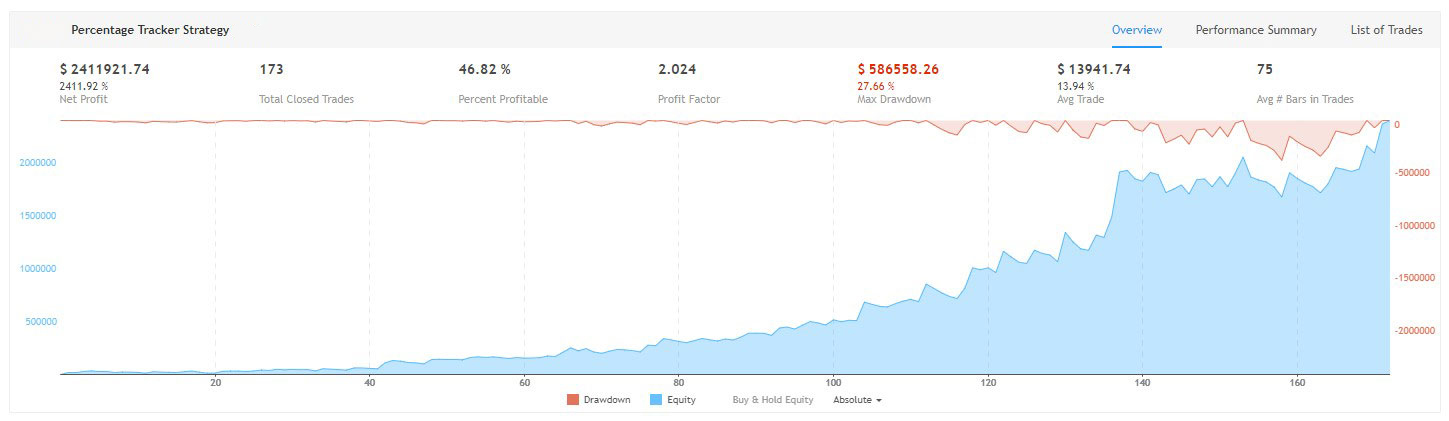

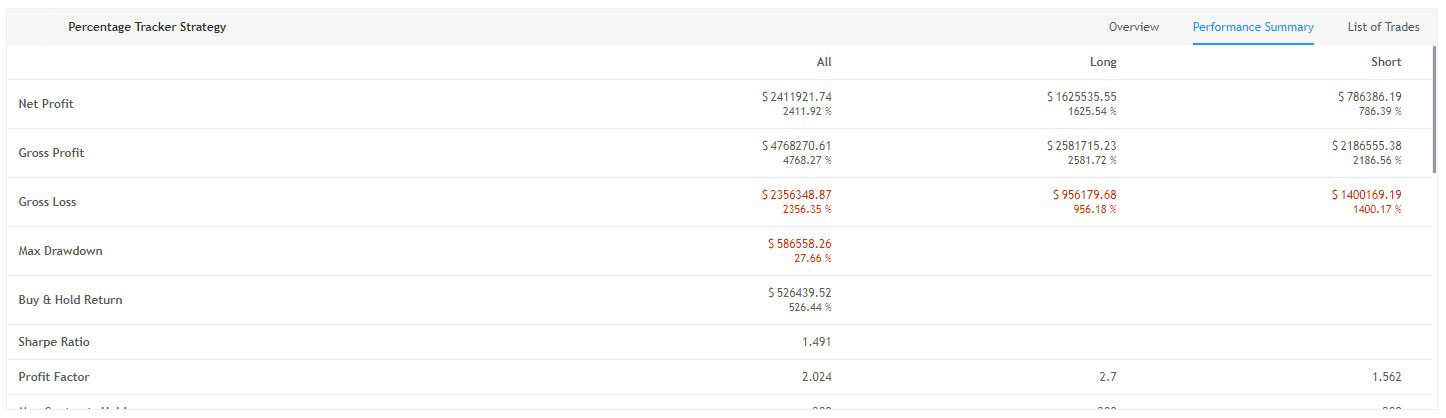

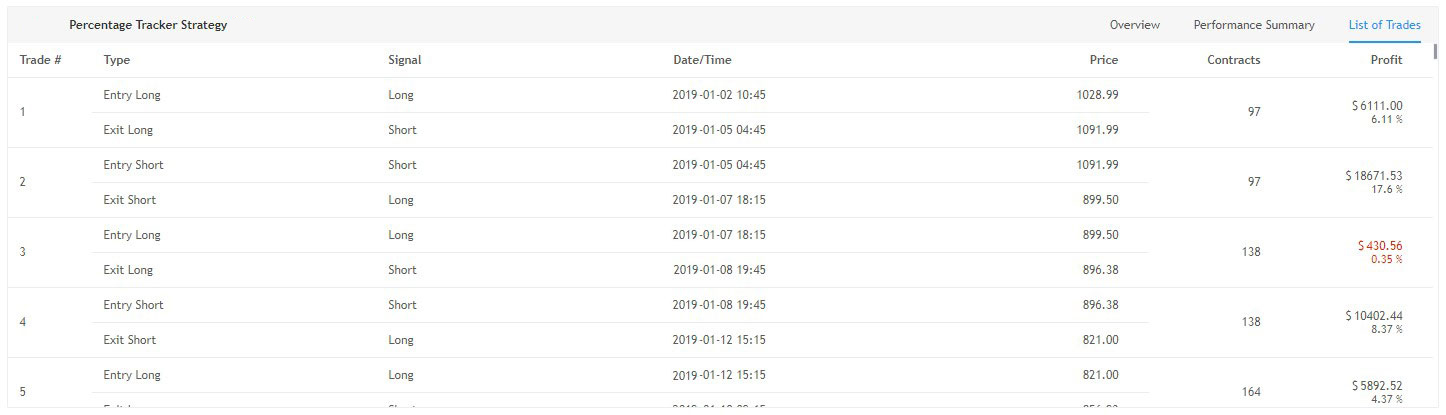

2. Percentage Tracker Strategy

The logic for this strategy is based on a percentage of price movement within a given time frame. It works both as a momentum catcher and a reversal catcher.

Here are the overall results of the Percentage Tracker Strategy and the average strategy result per trade.

This strategy showed a 2411,92% net profit after 173 trades. It means that the average result per trade was 13,94%. Besides, Percentage Tracker Strategy showed 47% of profitable trades. It�s a good additional strategy that mostly

15used along with other indicators and strategies. Sometimes it can also be used as the main strategy for certain assets.

RSI + Stochastic Strategy

The logic for this strategy is based on a combination of the Relative Strength Index (RSI) indicator and the Stochastic formula.

The Relative Strength Index (RSI) is a well-versed momentum-based oscillator which is used to measure the speed (velocity) as well as the change (magnitude) of directional price movements. Essentially the RSI, when graphed, provides a visual means to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash-settled instruments (stock indexes) and leveraged financial products (the entire field of derivatives); RSI has proven to be a viable indicator of price movements.

The Stochastic Oscillator is a range bound momentum oscillator. The Stochastic indicator is designed to display the location of the close compared to the high/low range over a user-defined number of periods. Typically, the Stochastic Oscillator is used for three things: Identifying overbought and oversold levels, spotting divergences and identifying bull and bear setups or signals.

Here are the overall results of the RSI + Stochastic Strategy and the average strategy result per trade.

16

The strategy gave 83,31% net profit after 11 trades, the average result per trade was 7,48%. Percent of profitable trades looks mediocre (45,45%) but it�s results of the separate test. Mostly, these indicators aren�t used separately but with other strategies. RSI + Stochastic Strategy gives important data to reduce risks and understand the current situation on the market/with an asset.

MACD + SMA Strategy

The logic for this strategy is based on a combination of the Moving Average Convergence Divergence (MACD) and the Simple Moving Average (SMA) indicators.

The MACD is an extremely popular indicator used in technical analysis. It can be used to identify aspects of a security's overall trend. Most notably these aspects are momentum, as well as trend direction and duration. What makes

17the MACD so informative is that it is actually the combination of two different types of indicators. First, the MACD employs two Moving Averages of varying lengths (which are lagging indicators) to identify trend direction and duration. Then, it makes the difference in values between those two Moving Averages (MACD Line) and an EMA of those Moving Averages (Signal Line) and plots that difference between the two lines as a histogram which oscillates above and below a center Zero Line. The histogram is used as a good indication of a security's momentum.

Moving averages visualize the average price of a financial instrument over a specified period of time. However, there are a few different types of moving averages. They typically differ in the way that different data points are weighted or given significance. A Simple Moving Average (SMA) is an unweighted moving average. This means that each period in the data set has equal importance and is weighted equally. As each period ends, the oldest data point is dropped and the newest one is added to the beginning.

Here are the overall results of the MACD + SMA Strategy and average strategy result per trade.

18

MACD + SMA Strategy has shown 1431,37% net profit with 31,81% average profit per trade during tests. It�s one of the most profitable strategies which includes extremely important indicators to understand market situation.

5. Fibollinger Strategy

The logic for this strategy is based on a combination of Fibonacci lines applied inside of the Bollinger Bands (BB) indicator.

Bollinger Bands (BB) are a widely popular technical analysis instrument created by John Bollinger in the early 1980s. Bollinger Bands consist of a band of three lines that are plotted in relation to security prices. The line in the middle is usually a Simple Moving Average (SMA) set to a period of 20 days (the type of trend line and period can be changed by the trader; however a 20-day moving average is by far the most popular). The SMA then serves as a base for the

19Upper and Lower Bands which are used as a way to measure volatility by observing the relationship between the Bands and price. Typically the Upper and Lower Bands are set to two standard deviations away from the SMA (The Middle Line); however, the number of standard deviations can also be adjusted by the trader.

Here are the overall results of Fibollinger and the average strategy result per trade.

Fibollinger is the strategy with the biggest percent of profitable trades � more than 80%. Robot uses this strategy to increase the chances of profitable trade and recheck the information which other indicators give.

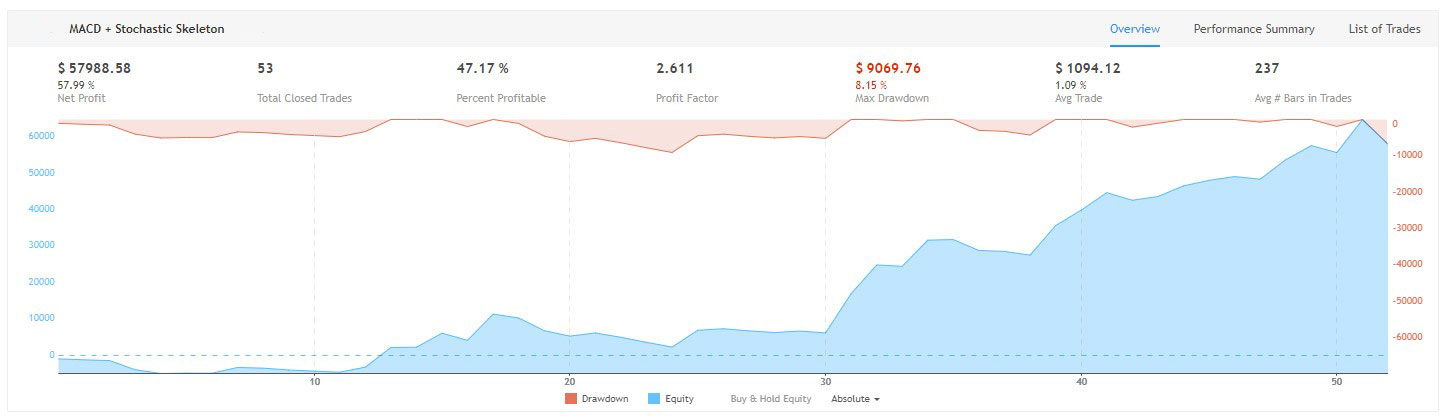

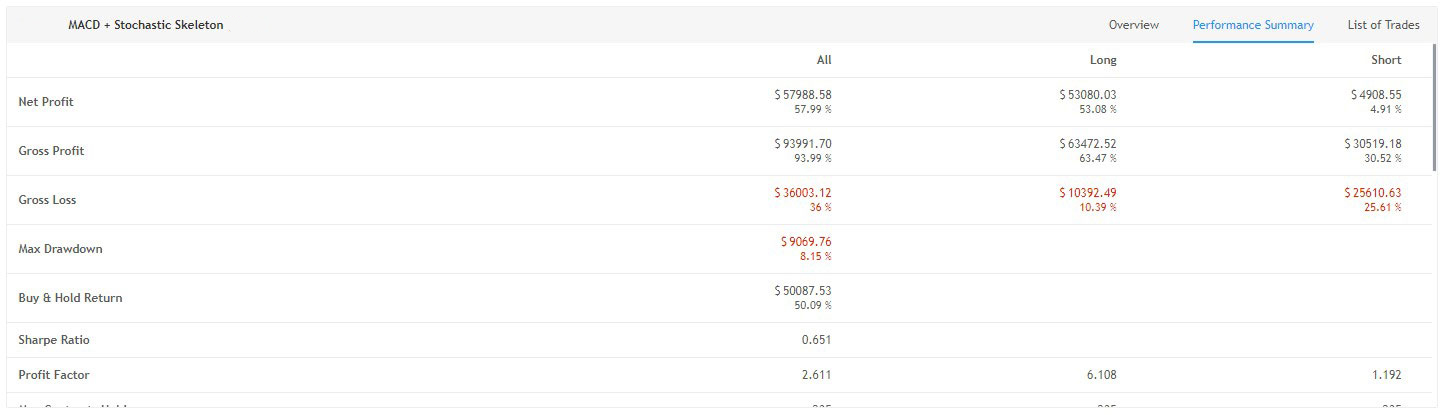

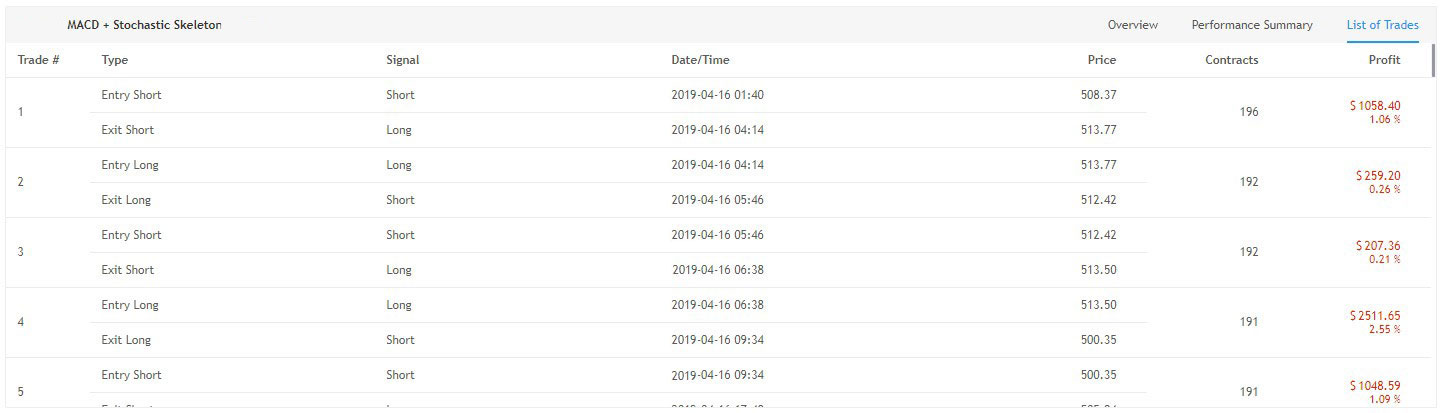

206. MACD + Stochastic Strategy

The logic for this strategy is based on a combination of the Moving Average Convergence Divergence (MACD) indicator and the Stochastic formula. We have described these indicators in previous strategies.

Here are the overall results of MACD + Stochastic Strategy and the average strategy result per trade.

It�s not a high-profit strategy (57,99% net profit after 53 trades) and it doesn�t give a high percent of profitable trades using separately. But it has one of the lowest max drawdowns, it means that this strategy is very important to reduce risks and control the situation. Mostly used along with other strategies.

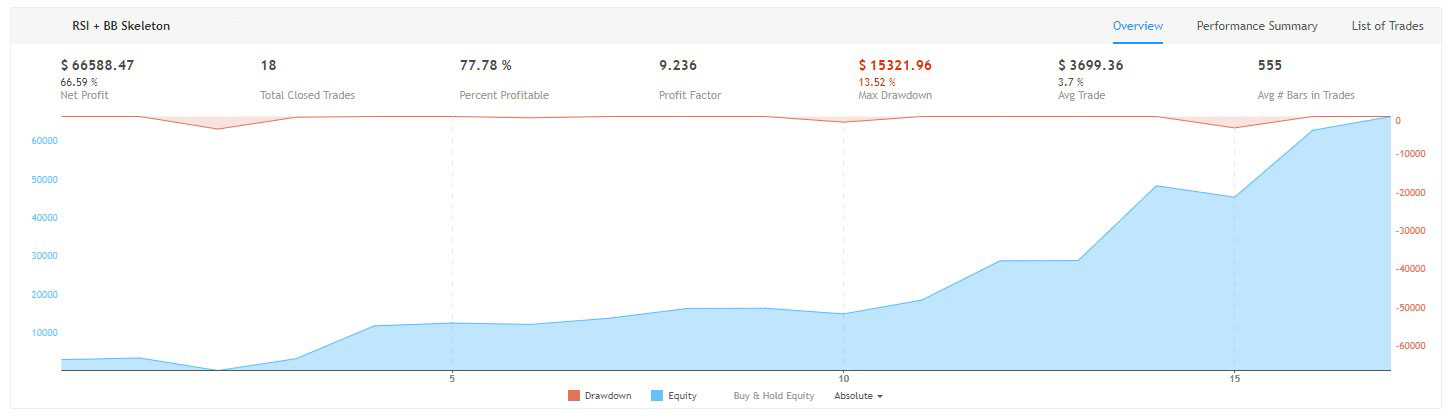

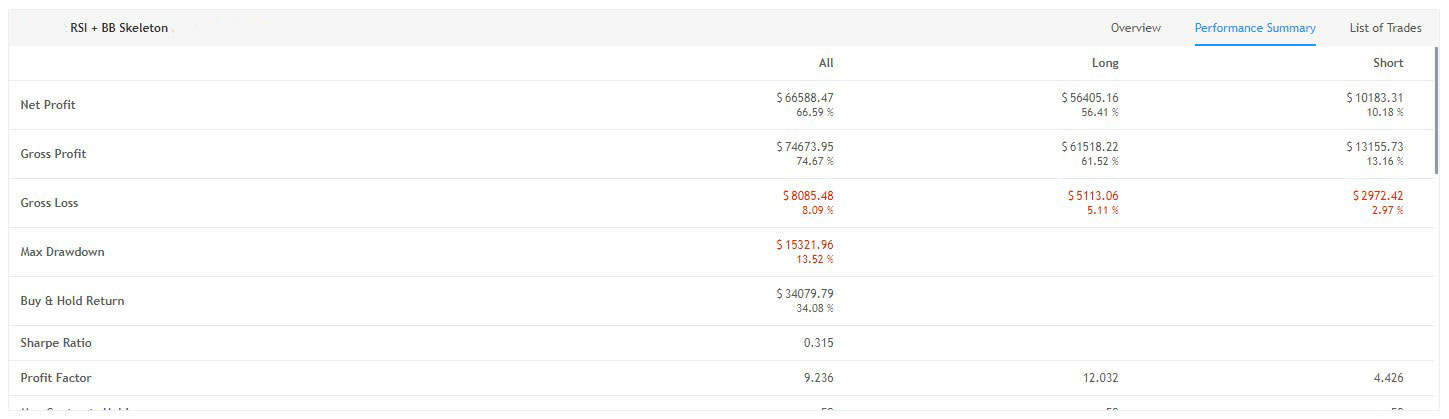

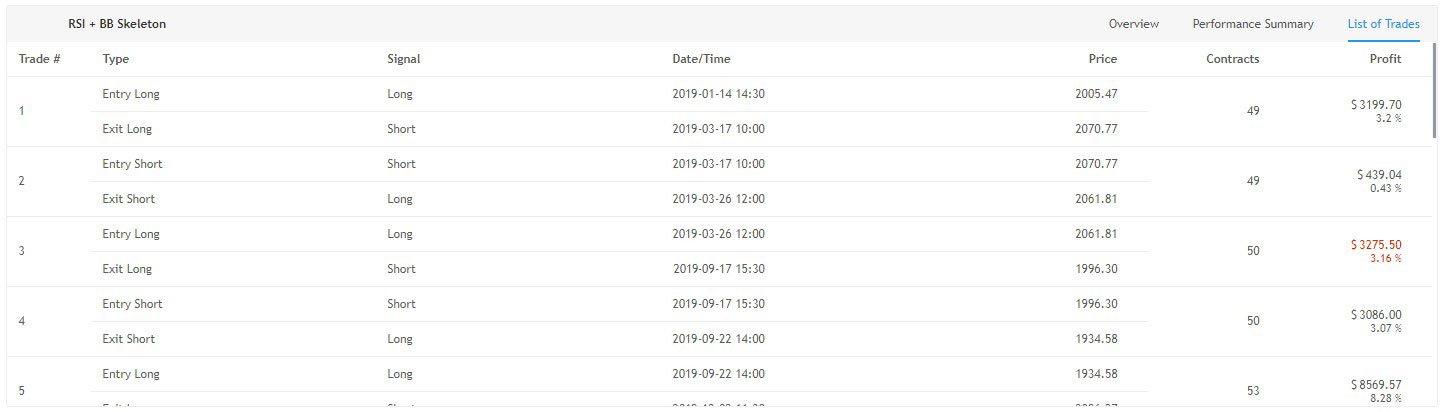

217. RSI + BB Strategy

The logic for this strategy is based on a combination of the Bollinger Bands (BB) and the Relative Strength Index (RSI) indicators. We have described these indicators in previous strategies.

Here are the overall results of RSI + BB Strategy and average strategy result per trade.

Another strategy which doesn�t give high profit but shows a stable result. RSI + BB Strategy shows the best correlation between percent of profitable trades and max drawdown. This strategy plays a significant role if the investor�s main goal is stable, not high profit.

228. Automatic Fibonacci Strategy

The logic for this strategy is based on Automatic Fibonacci reversal trend calculations.

Here are the overall results of Automatic Fibonacci and the average strategy result per trade.

This strategy is an important supporting element in automated trading. It finds areas where a retracement is coming to an end and a trend is likely to continue. Automatic Fibonacci is an auxiliary strategy which more concentrated on creating reliable trading signals and mostly used along with other strategies.

239. MFI + HA Strategy

The logic for this strategy is based on a combination of the Money Flow Index (MFI) indicator and Heiken Ashi candles that run in the background. Robot runs this strategy on regular candles.

The Money Flow Index indicator (MFI) is a tool used in technical analysis for measuring buying and selling pressure. This is done through analyzing both price and volume. The MFI's calculation generates a value that is then plotted as a line that moves within a range of 0-100, making it an oscillator. When the MFI rises, this indicates an increase in buying pressure. When it falls, this indicates an increase in selling pressure. The Money Flow Index can generate several signals, most notably; overbought and oversold conditions, divergences, and failure swings.

Heikin-Ashi means �average bar� in Japanese. Open, High, Low and Close prices of HA candlesticks are not actual prices, they are results from averaging values of the previous bar, which helps eliminate random volatility.

Pine function Heikin-Ashi creates a special ticker identifier for requesting Heikin-Ashi data with a security function.

Here are the overall results of MFI + HA Strategy and average strategy result per trade.

24

MFI + HA is one of the most stable strategies which has the lowest level of max drawdown and average per trade profit. The main goal of this strategy is saving investor�s money. It�s not a strategy for profitable trades but for hedging risks. Mostly used with other strategies.

Conclusion

A combination of these strategies allows Cryptex to get objective data about the market situation and to make much more profitable trades. The more strategies are used to analyze an asset or market, the more investor confidence that a trading signal will be successful. With Cryptex, an investor can not only automate the process of analyzing market indicators but also open and close orders much faster and accurate than a single person is capable of.

25